In its eight-year history, the Athletic Business Purchasing Survey has chronicled the kind of market volatility that could only be caused by a once-in-lifetime (we hope) globally catastrophic event. Our 2024 results suggest a continued calming of the economic turbulence experienced over the past four years by decision-makers in the athletics, fitness and recreation industries.

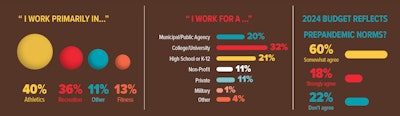

Specifically, this year’s respondents represent hundreds of professionals with purchasing power in athletics (40 percent), recreation (36) and fitness (13) while employed by colleges (32 percent), high schools (21), municipalities/public agencies (20), private businesses (11), nonprofits (11), military installations (1) or some other entity (4).

While a slightly smaller percentage of 2024 respondents report a budget increase this year over last (30 percent compared to last year’s record-tying 31 percent), only 9 percent of respondents are navigating 2024 with smaller budgets than they had a year ago. That’s an all-time low.

For the third straight year, we asked respondents how much they agree with the statement, “Our current budget and operations have returned to pre-pandemic norms.” A healthy 78 percent said they “somewhat agree” (60 percent) or “strongly agree” (18), while a mere 22 percent said “don’t agree at all.” That, too, marks a new low for the survey.

We asked for the fourth straight year whether purchasing plans have changed in recent months and found that the script has almost completely flipped. In 2021, 77 percent answered yes, and 23 percent said no. This year’s sample saw 30 percent say yes and 70 percent say no.

For the second year in a row, we asked about macroeconomic concerns and their potential impact on purchasing, and here, too, we found evidence of improvement in the collective mindset. Last year, 35 percent of respondents indicated they weren’t worried about the economy at large, 34 percent said they were worried and that the economy would impact their purchasing decisions, and another 31 percent said they were worried but wouldn’t alter their plans. This year, the percentage of respondents not worried about the economy rose to 42 percent, those worried enough to change plans dipped to 31 percent, and those worried with no plan to change dropped to 27 percent.

While all of the aforementioned appears to indicate that consumer confidence is trending in the right direction, spending priorities among survey respondents has remained largely consistent year over year throughout the survey’s history.

Thirty-eight percent of 2024 respondents said facility improvements topped their expenditures last year — aside from payroll and operational expenses — and even more (41 percent) expect that to be the case this year. Next in line last year were sports equipment (17), fitness equipment (15), aquatics/pool equipment (7), software/management tools (6) and sports surfaces (5). Same order, similar percentages moving forward: sports equipment (19), fitness equipment (11), aquatics/pool equipment (7), software/management tools (6) and sports surfaces (5).

Sixty-two percent of 2024 respondents report they have a facility project underway, are about to start a project this year or have one in the pipeline within the next five years. That bests our yearly average to date by a single percentage point. Project size remains consistent, as well, with the majority (59 percent) costing $5 million or less, 15 percent falling within a range of $6 million to $10 million, 12 percent between $11 million and $20 million, 10 percent between $21 million and $50 million, and 5 percent more than $50 million — though the latter figure represents a 50 percent decrease from a year ago.

As always, we’d like to thank all who took time to fill out the 2024 Purchasing Survey. Your continued participation has helped Athletic Business identify the rough patches, as well as this ongoing recovery period in which we seem to find ourselves, with as much accuracy as possible.