People who incorporate new companies seldom expend any energy deciding where to locate them.

Cybex's 340,000-square-foot manufacturing facility in Owatonna, Minn. (pictured) and a smaller facility in Medway, Mass., give it

Cybex's 340,000-square-foot manufacturing facility in Owatonna, Minn. (pictured) and a smaller facility in Medway, Mass., give itPeople who incorporate new companies seldom expend any energy deciding where to locate them. The company lives wherever the founder lives, and it stays there unless the company is sold to a buyer located elsewhere, acquires another company and consolidates operations, or gets a better offer from another state - or country.

All of these circumstances have gradually changed the fitness equipment industry's geography over time. Just last year, for example, strength and cardiovascular equipment manufacturer Star Trac of Irvine, Calif., was purchased by Michael Bruno, owner of StairMaster and Land America, a Chinese manufacturing company that previously handled part of Star Trac's production. (Almost all of its production has since shifted overseas to Land America.) Many instances of consolidation have merged the fortunes of strength equipment and cardio equipment manufacturers - Hammer Strength and Life Fitness, Icarian and Precor, Cybex and Trotter - giving these larger companies a theoretical choice of locations. And others have been lured to try out new locations because of the promise of cheaper labor, richer (state or national) government incentives for businesses or any number of other reasons.

By and large, business owners tend to play the geographical hand that's dealt them. If they aren't located near a major transportation hub, they or their customers will pay the (extra) freight. If production must increase to meet rising demand, the local workforce must be available to handle it.

Michael Rojas, president of Santa Ana, Calif.-based strength manufacturer Iron Grip Barbell Company, says there are "substantial benefits" to being located in certain states "where there is less business regulation, where the tax structure is different or where transportation hubs and nodes are more readily available. If we had it to do all over again, it's hard to say where we would locate the company, because ours is not one of the states that meets too many of those criteria. But it's a good place to live, and we have a large pool of highly skilled labor here. That has kept us in California more than any other reason. It isn't numbers that keep us here."

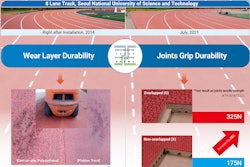

Similarly, Cybex International Inc. hasn't abandoned its 120,000-square-foot facility in Medway, Mass. (once home to Trotter exercise equipment, with which Cybex merged in 1997), in spite of its 2007 construction of a 340,000-square-foot manufacturing facility in its longtime home of Owatonna, Minn.

"Our workers have different competencies in both places, so combining wouldn't make sense even with the extra capacity available in Minnesota," says Art Hicks, president and COO of Cybex. "We think this gives us a lot more flexibility."

Cybex's expanded Minnesota operation took advantage of state and county help in securing land, and boasts access to a shipping channel (the St. Lawrence Seaway), a large workforce and a good business climate. The company is regularly courted by states offering tax abatements and other incentives to move its smaller New England location, however.

"We happen to have a history with Massachusetts, and we'll stay there as long as they don't drive us too crazy," Hicks says, making note of a state research and development tax credit that isn't as helpful to businesses as it purports to be. ("Try to get that credit, and you're basically guaranteed to get audited," he says.) But the alternative, moving elsewhere, is an even trickier proposition.

"Is it easy to move a manufacturing facility? No," Hicks says. "It isn't just you and me putting on a tool belt. If we up our workforce by 10 percent, it causes us headaches - can you imagine trying to recruit 300 people?"

At least one company can. In March, Woodinville, Wash.-based Precor opened a new 230,000-square-foot manufacturing facility in Greensboro, N.C., to produce its commercial strength lines. The move (from Valencia, Calif., where the company had a smaller facility) came after North Carolina, Guilford County and Greensboro plied the company with a reported $1.2 million in grants, tax credits and other benefits over a three-year period. A Precor spokesman at the time, Jim Zahniser, told the Seattle Times in 2008 that the issue was proximity to East Coast and European markets. "We need to be closer," he said. "We're shipping a lot of steel."

Greg May, Precor's vice president of engineering and manufacturing, says the move "went exceptionally well for us," but concedes that putting together a new workforce of perhaps 100 employees on the factory floor (welders, painters, assembly workers) wasn't at all easy. "We didn't get a lot of people moving with us from California out to the East Coast," May says. "Trying to instill the Precor culture out there has been the biggest challenge. There's a certain way of working that we like that's very collaborative and open, and utilizes the workforce's ideas to continuously improve the operation. We really needed to install a veteran company general manager out there to make it happen."

Made in America. American made. Proudly made in the U.S.A. With words like these, domestic companies construct a compelling narrative to, they hope, promote brand loyalty and boost sales. Buying locally, goes the promise, means quicker lead times and higher-quality equipment. Just as important, they would suggest, purchasing their products means jobs for Americans - a win for the home team in a highly competitive global game.

Cue the Bruce Springsteen music. But what does it really mean?

There is plenty of anecdotal evidence to back up each of the made-in-the-USA claims - and yet, strength equipment manufacturers located elsewhere in the world have compelling narratives of their own that center on affordability or manufacturing prowess to rival that of domestic suppliers. Added to which, most if not all manufacturers boast of links to, operations in, or source materials and parts from more than one country - Precor, for example, is a subsidiary of Amer Sports Corp., located in Helsinki, Finland - which would at first blush appear to add a shade of gray to every red, white and blue proclamation.

"Amer doesn't have any involvement in our operation," May says, noting that the sporting goods giant is best known for outdoor sports equipment and exists primarily as a holding company for brands including Wilson, Salomon, Suunto and others. "A lot of what they do is skis, bindings and boots. Our equipment is different; it's more heavy equipment. We still talk from time to time about moving manufacturing over there, but at this point in time, we're still fully utilizing the factories that we have here, and Amer doesn't have extensive factories over there, either."

The general equation when an overseas manufacturer supplies the U.S. market reads that the lower cost of foreign labor and materials outweighs the higher cost of transporting goods long distances by rail, container vessel and road. This is not always the case, as Technogym can attest. The Cesena, Italy-based company manufactures the bulk of its products there, though it opened a second manufacturing facility in Slovakia, where labor is cheaper, in 2006.

"Labor costs are generally higher in Europe than in the U.S.," says Federico Foli, Technogym's North American COO. "However, as each country in Europe has a unique workforce, wage regulations, unionization and employee protections, it is difficult to compare labor costs. Different countries in Europe and states in the U.S. will have different standards. For example, Slovakia might have lower costs than most of Europe, whereas the Northeast in the U.S. may have higher costs than other states."

Even in China, where labor costs are estimated to run more than 40 percent below those in the United States, there is a large variance between urban and rural manufacturing centers.

Iron Grip's Santa Ana, Calif., facility is home to a variety of manufacturing equipment made by outside fabricators to the company's own specifications. (Photo courtesy of Iron Grip Barbell Company)

Iron Grip's Santa Ana, Calif., facility is home to a variety of manufacturing equipment made by outside fabricators to the company's own specifications. (Photo courtesy of Iron Grip Barbell Company)"The way free weights are made in China is very labor-intensive," says Rojas, who says Iron Grip made a significant investment in acquiring and developing its own automated manufacturing equipment. "You'd think they'd always be made in a product-specific factory, but many are actually made using a variety of methods, everything from old equipment that is not automated in any sense of the word to actual holes in the ground that people pour molten iron into. In terms of the manufacturing process, it's as foreign as it could be."

Conversely, as Rojas is quick to point out, China is able to produce high-priced computer systems, e-readers and cellphones. "Some high-quality parts can be produced in China, or at least assembled in China, as is being done by Apple, for example, in a dedicated facility overseen with similar quality control as you'd see in the U.S.," he says.

"In general, Italy has a very strong mechanical manufacturing culture, and Technogym specifically is located within the specialized manufacturing district, with Ferrari and Maserati facilities just a few miles away," adds Foli, spelling out his company's particular compelling narrative.

Transportation, the other side of the equation, Foli says, is overstated in terms of its effect on retail price - at least in a global sense. "As an Italian manufacturer, Technogym faces high shipping costs into the U.S. compared to domestic equipment transport, but U.S. manufacturers face the same issues when exporting their products," he notes. (To help reduce lead time, Technogym in 2010 implemented a new logistics structure in the U.S. in which an inventory of the company's most popular equipment selections are stocked in a Pennsylvania warehouse.)

"Commodity prices and the cost of shipping weigh heavily on all manufacturers who are exporting," says Precor's May. "Fortunately, our weak dollar relative to the Euro has helped some."

Unfortunately for many global brands, transportation costs have increased considerably with the rise in worldwide oil prices. Strength equipment manufacturers producing goods in China have endured a double whammy: higher transportation costs coupled with rising labor costs, as China greatly expands production of domestic infrastructure. The steel industry, too, has seen extremely volatile pricing, as heightened steel use in China leads to global demand far exceeding supply. These were all contributing factors in Fallbrook, Calif.-based Med-Fit Systems Inc.'s decision to shift its manufacture of Nautilus products from Taiwan and China to its year-old Independence, Va., facility this past May.

"Labor savings in China were substantial five or six years ago, but as labor prices have crept up and transportation costs have risen, the gap between the cost of Chinese imports and American-made product has narrowed substantially," says Rojas. In his view, as prices rise, the quality of the finished product can't help but be compromised.

"That companies are still importing goods from China probably demonstrates the substantial savings in labor and materials that still can be achieved there on a product category like free weights," he says. "But common sense would tell you that if you can make something in China and ship it all the way here in a container ship and it's still cheaper than an American-made product, something's giving somewhere."

Rojas says that his company's decision to keep production in the U.S. in its formative years had less to do with location and more to do with control.

"Outsourcing production, wherever you do it, is not the same as making it yourself," he says. "There's a level of trust you have to have in another manufacturer that they're actually honoring your specs, diagrams, drawings, materials and processes. We made a conscious decision to avoid that. In the early 2000s, we were building our manufacturing processes out and it was an extremely capital-intensive investment. Along the way, we invented some proprietary manufacturing techniques that involved equipment that we had manufactured for us to our specs. One by one, we took every process in-house."

Cybex's Hicks says his company has sent manufacturing staff abroad to tour facilities in other countries, in part just to keep tabs on potential overseas opportunities. He's comfortable they've made the right call for the long term and sees many advantages in being able to oversee production on a day-to-day basis.

"I think 1 percent of our content on our strength equipment gets made outside the U.S., maybe a pulley part or something that you can't find here anymore, but otherwise we source our steel here - cables, upholstery, all that stuff," Hicks says. "For us, manufacturing in the U.S. has been critical. It has helped us with our lead times, which U.S. clubs are sensitive to, allowed us to do more timely customization, freed up capital to invest in automation and other technology, and speeded up the cycle of new product development to production. Even if you design something here and make it overseas - and we had a little experience with that on an experimental basis - it is not easy."